| The Q3 2025 Forisk Research Quarterly (FRQ) report includes industry analysis and market forecasts through 2034 for timber prices, logging costs, softwood lumber production, structural panels production, paper and paperboard production, forest supplies, and wood bioenergy markets. Select summary findings from the Q3 FRQ report include:

Macro and Housing: The economy grew at a 3.0% annualized pace in Q2 2025. The unemployment rate increased to 4.2%. Yields on 10-year U.S. Treasuries fell to 4.4% in Q2 2025 from 4.5% during Q1 2025. Single family starts declined 6.9% in Q2 2025 relative to last year, while multifamily starts increased by 17.1%.

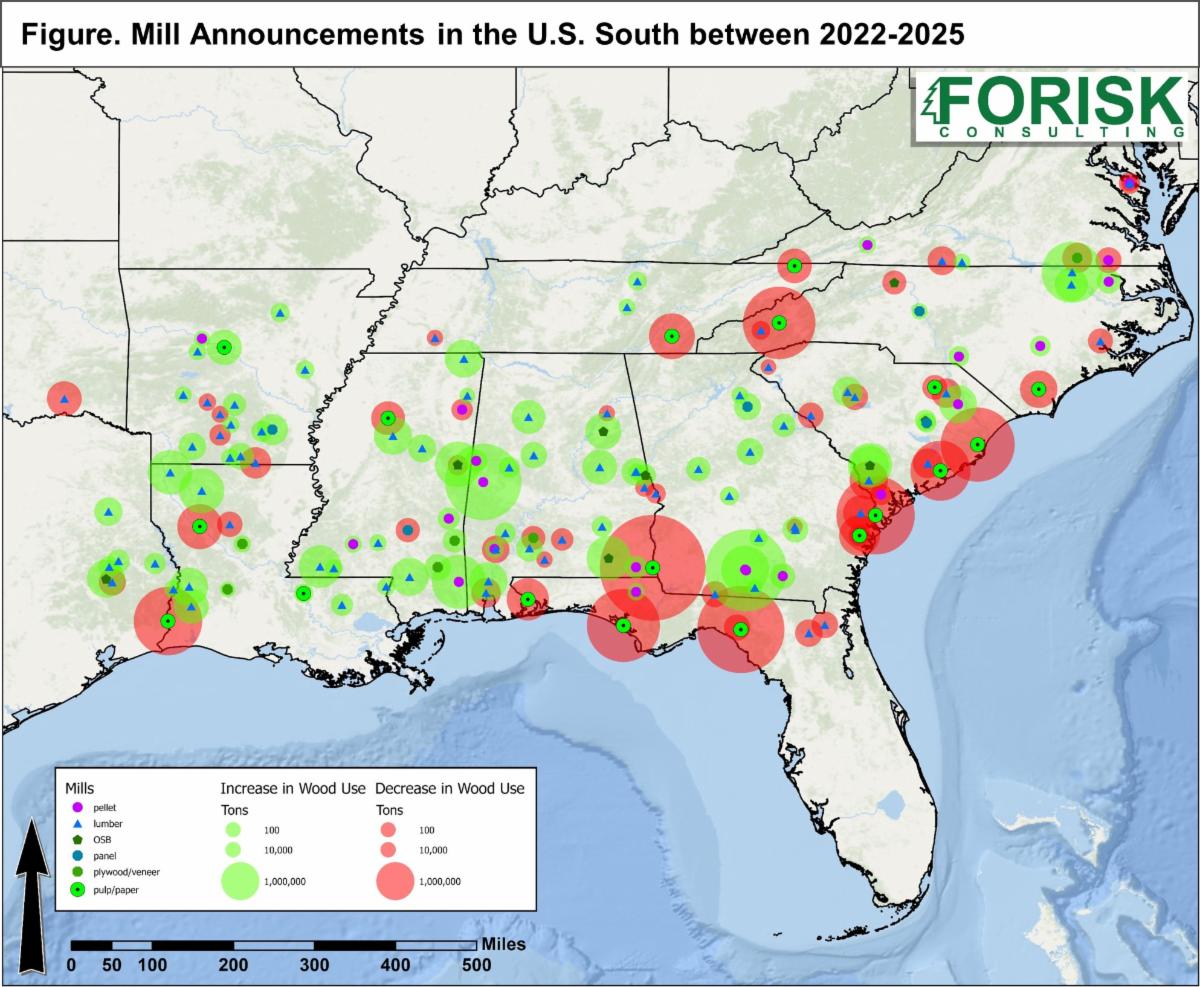

Lumber: North American softwood lumber production was flat for Q1 2025 year-over-year. The softwood lumber Producer Price Index declined 2% in Q2 2025 but increased 9% year-over-year. U.S. South sawmill investments continue with $1 billion in announced projects from 2025 to 2027.

Structural Panels (OSB & Plywood): Quarter-over-quarter average U.S. structural panel prices declined 21% for OSB and 2% for plywood in Q2 2025. Capital projects in the sector will expand North American capacity over 3.6 BSF and cost ~$1.8 billion through 2027. Canada accounted for 48% (3 BSF) of all U.S. structural panel imports through May 2025.

Pulp & Paper: Paper and paperboard production is down 2.6% from mid-year 2024. Packaging production fell 2.7% for the quarter, newsprint was up 4% for the quarter, and tissue production increased 1%, but all sectors fell year-over-year. Printing/writing production decreased 3.3% and is down 6.1% year-over-year. OCC prices dropped 2% in Q2 and are down 30% year-over-year. Average market pulp prices are up 2% year-over-year.

Wood Bioenergy: Bioenergy products that pass Forisk’s Wood Bioenergy Database screening plan to consume 98.1 million green tons per year of wood across the country. The U.S. South leads all regions in total projects and demand. Most bioenergy projects continue to be in the biomass-to-electricity, CHP, and pellet segments, though renewable hydrocarbon projects (liquid fuel and biochar) are increasing. Through May 2025, U.S. wood pellet exports increased 1% year-over-year while Canadian wood pellet exports increased 22%.

Log & Chip Exports: Through May 2025, year-over-year Canadian softwood exports were down 13% while U.S. softwood log exports were down 25%. U.S. South softwood chip exports for the period were flat over last year. Year-to-date southern softwood log exports increased 22% year-over-year while western softwood log exports decreased 49%. Northern softwood log exports rose 1%. Canada, Japan, and Vietnam, account for 79% of U.S. log and chip exports.

Timberland Investments: Public timber REITs returned -4.4% YTD through July 25th after returning -19.1% in 2024. Rayonier and Weyerhaeuser are trading down year-to-date while PotlatchDeltic is up. As a sector, public timber REITs increased 5.7% for the quarter according to the market cap weighted Forisk Timber REIT Index (FTR). Nearly 0.9 million acres of industrial timberland transactions closed in the United States for the last four quarters. TIMOs accounted for 67% of the acreage bought, while private sellers accounted for 47% of the acreage sold.

Forest Operations: U.S. logging employment declined over 3% in 2024 for the third year in a row, led by 4% declines in the U.S. South. Canadian employment dipped over 1% year-over-year. Logging wages increased across North America, surging more than 4% in the U.S., with slower growth in Canada. Trucking freight shipments recovered 1% while trucking employment fell an additional 2%.

Timber Markets, U.S. South: Southern stumpage prices increased for pine chip-n-saw and pine sawtimber in Q2 2025 and decreased for all other products, according to Timber Mart-South. The 2025 forecast for pine sawtimber increases 0.8% over the 2024 price. Pine pulpwood stumpage prices are projected to increase the most through 2029 in Alabama.

Log Prices, Pacific Northwest: Domestic Doug-fir log prices rose 1% quarter-over-quarter in Oregon and 4% in Washington. Export Doug-fir prices rose 15%, while export hemlock prices increased 17%. Forisk’s “base case” projects a slight increase for Doug-fir prices in 2025 followed by larger increases in 2026. Logging and hauling costs are projected to increase slightly over the next decade.

Hardwood Markets, U.S. North: Forisk’s Hardwood Price Index increased 1.8% in Q1 2025, up 10.2% year-over-year.

To learn more about the Forisk Research Quarterly (FRQ) subscription, click here or contact Nick DiLuzio (ndiluzio@forisk.com). |