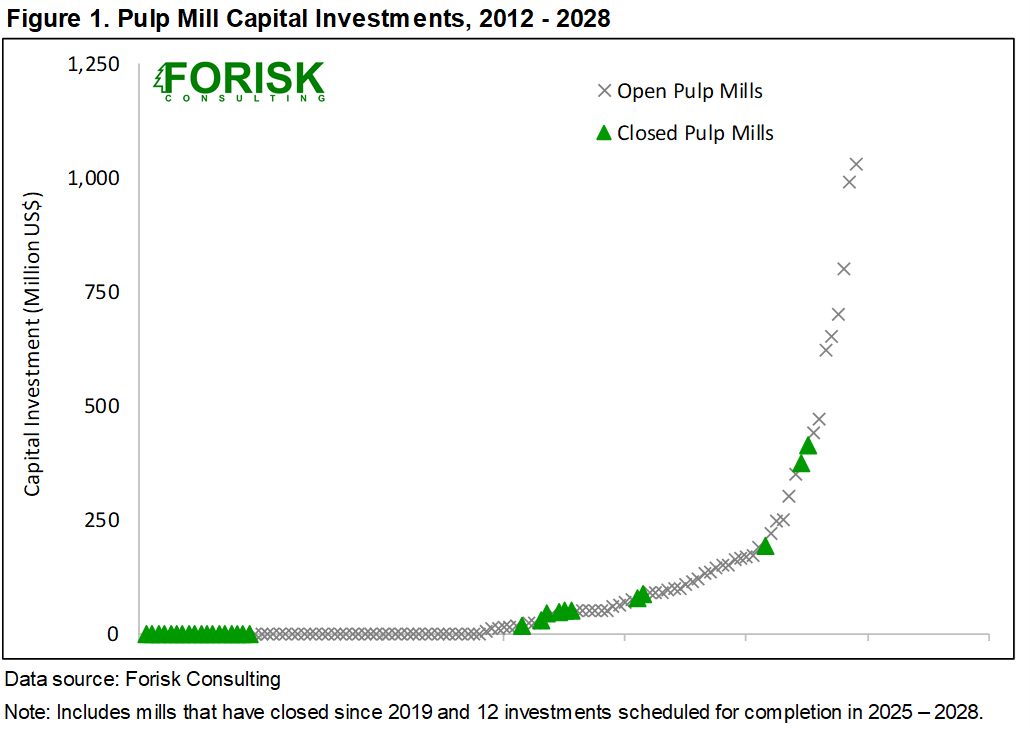

| Each quarter, Forisk Consulting compiles data on mill activity through its ongoing tracking of wood-using facilities as part of Forisk’s North American Mill Capacity Database, a database of over 2,300 wood-using mills in North America. This release provides a summary of research from the Mill Capacity Database and the Q4 2025 edition of the Forisk Research Quarterly. Forisk Consulting analyzed 29 pulp mills that closed in the U.S. since 2019 and identified four factors that contributed to mill closures: 1) exposure to weak end use markets, 2) lack of investment (particularly in pulping infrastructure), 3) age of the pulp mill recovery boiler, and 4) challenging procurement logistics. Forisk developed a framework to screen open pulp mills for risk of future closures from these factors and applied that framework to mills in the U.S. Pacific Northwest, U.S. South, and U.S. North in the Forisk Research Quarterly report. Based on the risk assessment framework, 21 out of 88 open pulp mills fell into the category of “high risk” of closing, including 10 mills in the U.S. South, 3 mills in the Pacific Northwest, and 8 mills in the U.S. North. Forisk’s Mill Capacity Database tracks capital investment and end market exposure for mills. Closing non-performing assets and high-cost mills are efforts to improve shareholder value. As such, lack of capital investment can indicate at-risk mills, while investments signal a commitment to operating a facility. “Investments in pulping infrastructure – woodyard, digester, and recovery boiler – may indicate a higher commitment to the facility than investments in other mill infrastructure, like the paper machine,” says Amanda Lang, President and COO of Forisk Consulting. “While 11 mills that closed since 2019 had capital investments, only 3 invested in pulping components, according to our research.” |

No comments:

Post a Comment